Saudi Arabia ranks 6th globally in the UN’s 2024 E-Government Development Index[?].

Vision 2030 is shaping procurement in construction by raising the baseline for how buying decisions get governed, documented, and defended. Procurement is moving closer to delivery risk, so construction procurement trends now show up in schedule certainty and cost control.

The current trends in construction procurement reflect that shift. Owners expect clearer supplier qualification, stronger localization plans, and cleaner approvals that stand up to audit and dispute pressure. These trends in construction procurement are changing what “procurement readiness” looks like on day one.

That is why digital procurement is becoming central to how contractors operate under Vision 2030. Done well, digital procurement creates traceability from BOQ to purchase to payment, which supports the construction procurement trends now shaping

Saudi projects.

Strategic Drivers Shaping Trends in Construction Procurement

Vision 2030 is shaping procurement because it changes what public and private owners want to achieve through construction. Procurement is being used to support economic development, improve governance, and reduce delivery risk.

For contractors, this explains why trends in construction procurement are shifting at the same time across localization, compliance, sustainability, and technology. These drivers sit behind many construction procurement trends you see in tenders today.

Economic Diversification and In-Country Value (ICV)

Economic diversification pushes construction procurement toward local content and local supplier participation. This changes how contractors plan sourcing long before procurement teams start issuing POs.

Saudi regulations that prefer local content and local SMEs in procurement transactions reinforce this direction and make localization easier to measure and enforce[?].

This is why current trends in construction procurement include supplier ecosystem building, capacity checks, and stronger documentation for origin and qualification. Many contractors are treating supplier development as part of project planning.

Common procurement actions linked to these construction procurement trends:

Earlier prequalification focused on capacity and lead times

package strategies that reduce import dependency for critical items

partnerships with local suppliers to raise reliability and compliance readiness

Legal, Regulatory, and Governance Reforms

Procurement governance reforms shape how tenders run and how award decisions get defended. Contractors increasingly need consistency in evaluation, approvals, and record keeping.

The Government Tenders and Procurement Law sets principles for public tenders, including publicity, transparency, and equal opportunity[?].

This pushes trends in construction procurement toward standard workflows and clearer approval authority. It also increases the cost of informal procurement decisions that cannot be traced back to a policy, approval, or contract clause.

Sustainability, ESG, and Green Transformation

Sustainability targets are moving from policy language into project expectations. Procurement teams feel this through requirements around materials, certifications, and evidence that suppliers can meet green standards.

Saudi Green Initiative sets a target to reduce carbon emissions by 278 million tons per year by 2030[?].

This is shaping current trends in construction procurement toward earlier materials planning and fewer late substitutions. Contractors also need stronger supplier verification so ESG requirements do not become a last-minute delay driver.

Technology and Digitalization Push

Mega-project delivery depends on faster coordination across design, procurement, commercial, and site teams. Vision 2030’s digital direction reinforces expectations for cleaner data and more traceable decision-making.

Saudi Arabia’s UN 2024 e-government data shows a global rank of 6 on EGDI and 7 on e-participation[?].

This helps explain why digital procurement is becoming central to procurement operations. When procurement data connects to BOQ, budgets, approvals, and inventory, teams can reduce cycle time and control spend with fewer gaps.

It also introduces a new requirement: governance for the data and the workflow. Without defined authority, clean item masters, and consistent rules, digital procurement can produce more activity without better control.

Current Trends in Construction Procurement

The strategic drivers are now visible in how projects get packaged, tendered, and governed. These current trends in construction procurement are shifting day-to-day behavior for owners, consultants, and contractors.

What matters is the practical impact. Many construction procurement trends are shortening decision windows, increasing documentation requirements, and pushing teams toward digital procurement to keep control without slowing execution.

Local Sourcing and Supplier Ecosystem Building

Localization is moving from a narrative to a scored requirement. The focus is on proving local contribution through supplier selection, contract structure, and documented origin of goods and services.

This is one of the most consistent trends in construction procurement because it affects procurement planning early. Contractors are building sourcing strategies around supplier readiness, lead-time reliability, and compliance documentation.

In practice, teams are doing three things more often:

Expanding approved vendor lists with verified local capacity

Splitting packages to fit local capability without harming schedule logic

Setting supplier performance expectations earlier, before mobilization

Early Contractor Involvement and Collaborative Contracting

Owners want fewer late surprises, so they are bringing delivery partners in earlier on complex packages. This reduces design rework and compresses procurement decisions into earlier phases.

That is why construction procurement trends include more collaborative commercial models, including target-cost approaches and structured risk-sharing on major scopes. These models are especially common when timelines are fixed and interfaces are complex.

PPPs also support this direction by formalizing long-term performance and risk allocation under Saudi Arabia’s privatization and PPP framework.

End-to-End Digital Procurement and Autonomous Systems

The market is moving toward end-to-end traceability, from tender to contract to purchase to payment. This is where digital procurement becomes a practical requirement rather than a systems upgrade.

Etimad was launched as part of Saudi Arabia’s e-procurement direction, with the aim of unifying and simplifying government tenders and procurement processes[?].

This shift is driving current trends in construction procurement like standardized approval workflows, clearer audit trails, and real-time reporting. It also makes data quality a procurement risk, since bad item masters and inconsistent coding distort budgets and control.

Resilient Supply Chains and Risk Management

Procurement teams are treating resilience as a cost and schedule control discipline. The goal is to reduce exposure to single-source suppliers, single-country routes, and last-minute substitutions.

This is showing up in trends in

construction procurement, such as deeper supplier due diligence, earlier expediting plans for long-lead items, and clearer contractual accountability for delivery dates and documentation.

It also increases third-party risk expectations. More teams are formalizing onboarding checks, performance tracking, and compliance documentation as part of standard buying.

Inflation and Cost Control Strategies

Cost control is now more tied to procurement structure than to negotiation skill. Contractors are using tighter package strategies, clearer escalation rules, and spend visibility tied to BOQ and project budgets.

Saudi Arabia’s CPI annual inflation rate was 1.9% in November 2025, with a monthly CPI change of 0.1% reported by GASTAT[?].

Even with a stable headline CPI, project inputs can still move unevenly by category and timing. That is why construction procurement trends include earlier locking of critical commodities, tighter change control, and faster approvals supported by digital procurement.

ESG-Driven Procurement and Green Building Practices

ESG is shaping procurement through materials selection, supplier requirements, and documentation. The procurement impact is concrete: certifications, lifecycle cost logic, and controlled substitutions show up earlier in the project cycle.

Saudi Green Initiative states a target to reduce carbon emissions by

278 million tons per year by 2030, which reinforces demand for lower-carbon approaches across sectors.

This trend pushes teams to align design specs with market availability sooner. It also raises the value of supplier transparency, since missing ESG evidence can delay approvals and payments.

Talent and Skill Building

Procurement is becoming more data-driven and governance-heavy, so skill needs are changing. Teams need stronger capability in analytics, contract discipline, supplier management, and systems adoption.

Vision 2030’s Human Capability Development Program was launched in 2021, reflecting the broader push to build future-ready skills across the economy[?].

For contractors, the implication is direct. These current trends in construction procurement require structured roles, clear authority, and training that make digital procurement usable under real project pressure.

Challenges in Implementing Construction Procurement Trends

Even when contractors agree with the direction of Vision 2030, execution is where friction shows up. Many teams are trying to adopt new procurement disciplines while still delivering under tight timelines.

These challenges explain why current trends in construction procurement can look strong on paper and uneven on-site. They also show why digital procurement succeeds in some firms and stalls in others.

Institutional Barriers and Resistance to Change

Procurement touches every function, so change creates pushback fast. People protect familiar routines, especially when projects already feel overloaded.

Localization requirements can also expose capability gaps in the supplier base. Saudi Arabia’s local content preference framework makes localization easier to measure, which increases pressure on contractors to operationalize it.

A common failure point is unclear authority. If teams do not define who can approve supplier exceptions and price changes, procurement slows or becomes inconsistent.

Technology Adoption Barriers

Many contractors still run procurement across disconnected tools. That makes it hard to connect BOQ, budgets, approvals, purchasing, and inventory without manual work.

Governance expectations keep rising in parallel. The GTPL emphasizes principles such as publicity, transparency, and equal opportunity in public tenders, which raises the value of traceable decisions.

The hardest part of digital procurement is usually data and process discipline. If item masters, cost codes, and supplier records stay messy, the system will not produce reliable control.

Supply Chain and Market Limitations

Some categories still depend on imports, long lead times, or limited supplier depth. That makes localization targets harder on specific packages, even when the intent is clear.

These constraints push trends in construction procurement toward earlier planning for long-lead items and tighter supplier qualification. Teams that wait for site urgency often end up with substitutions that create re-approvals and delay risk.

Procurement leaders also need stronger expediting and supplier performance tracking. Without it, schedule risk shifts from planning into reactive buying.

Regulatory and Contractual Ambiguities

Regulation is moving fast, and interpretation can vary across stakeholders. Contractors can end up managing uncertainty across tender clauses, evaluation criteria, and contract enforcement expectations.

This is where documentation becomes practical protection. When procurement decisions have a clear basis and a clear approval path, disputes become easier to manage.

Sustainability adds another layer of ambiguity, especially around proof and documentation. Saudi Green Initiative’s stated target to reduce carbon emissions by 278 mtpa by 2030 reinforces why owners increasingly ask for evidence, not verbal assurance.

Best Tips for Digital Procurement

Tips for Digital Procurement

Digital procurement works best in construction when it supports delivery control, not just purchasing speed. Under Vision 2030 expectations, contractors need workflows that stay consistent even when the site is under pressure.

These tips focus on what makes digital procurement usable on live projects and what reduces the risks that come with new systems.

Align procurement rules to Vision 2030 project expectations

Start by translating high-level requirements into simple procurement rules your team can follow. Include localization evidence, documentation standards, and governance requirements that tenders commonly expect.

Write these rules in plain language and build them into approvals. That keeps digital procurement aligned with how you actually get packages delivered.

Define authority and approval paths before you configure the system

Most delays come from unclear authority. Define who can approve supplier additions, price changes, substitutions, and emergency buys.

Map approvals by value, package type, and risk level. Then configure digital procurement to enforce that map automatically.

Clean master data and cost coding early

Bad master data breaks control fast. Standardize supplier records, item naming, units, tax rules, lead times, and payment terms.

Align cost codes to BOQ and budgets so every purchase lands in the right place. This supports the current trends in construction procurement that demand traceable decisions.

Connect BOQ to purchasing and prevent scope leakage

Tie requisitions and POs to BOQ lines where possible. Require a reason code for anything outside BOQ, including client variations and internal changes.

This is one of the most practical construction procurement trends because it protects margin and reduces unauthorized spend.

Build controls that help the site instead of slowing it down

Automate checks that catch issues early, including budget availability, duplicate orders, contract pricing, and supplier compliance status.

Keep emergency buying possible with a controlled workflow. This makes digital procurement resilient without creating workarounds that destroy traceability.

Treat supplier onboarding as a procurement capability, not paperwork

Standardize onboarding requirements, including documents, certifications, delivery capacity, and contact accountability.

Track supplier performance in simple metrics like lead time reliability, quality issues, and documentation accuracy. This supports trends in construction procurement focused on risk and resilience.

Train by role, then enforce adoption with simple metrics

Train procurement, commercial, project managers, and storekeepers differently. Each group uses different screens and makes different decisions.

Track adoption using a few indicators, like PR-to-PO cycle time, percent of spend on contract, and percent of purchases linked to BOQ. Use those metrics to improve the process, not to police people.

Protect the workflow with access controls and audit discipline

Set role-based access for approvals, vendor edits, pricing fields, and inventory adjustments. Log changes and keep records that are easy to retrieve. Strong controls make digital procurement credible during audits and disputes, which aligns with the direction of current trends in construction procurement.

How FirstBit Is Revolutionizing Digital Procurement for Vision 2030 Projects

On Vision 2030 projects, procurement teams need traceable decisions, faster approvals, and tighter control over budgets. This is where digital procurement becomes practical, because it reduces manual gaps between site requests, supplier quotes, and purchase execution.

Requisition-to-purchase flow.FirstBit ERP supports creating requisitions (including from the site) and generating purchase orders as part of the procurement process.

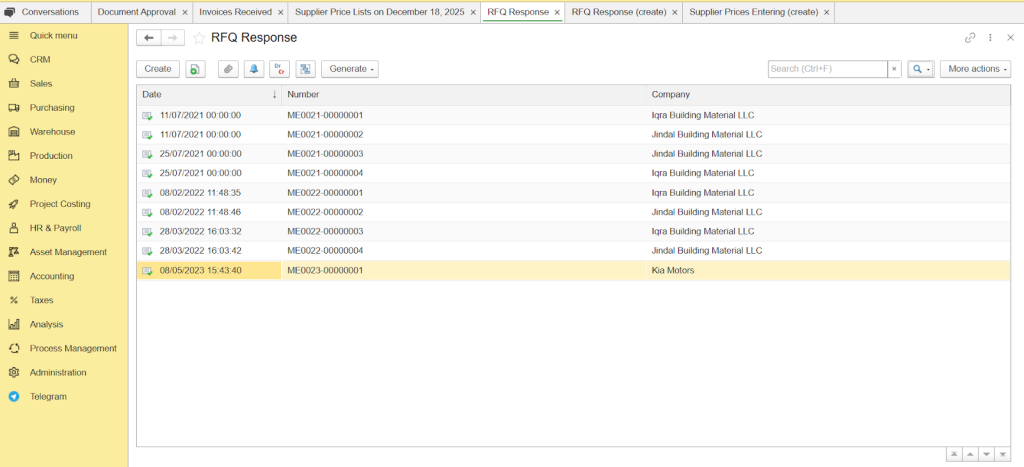

RFQs and supplier bid collection. The procurement workflow includes RFQ generation, and suppliers can submit quotations through Excel import or a generated link for faster collection.

Side-by-side supplier comparison. Quotation data can be compared on a single screen using price and custom-defined parameters, with supplier files attached for reference.

Quotations by different suppliers in FirstBit ERP

Multi-level approvals by design. The system includes an approval designer tool to configure multi-level workflows for procurement transactions, including material requisitions.

Purchase order tracking and fulfillment control. Purchase orders can be tracked to support order fulfillment visibility and reduce the risk of missed site deliveries.

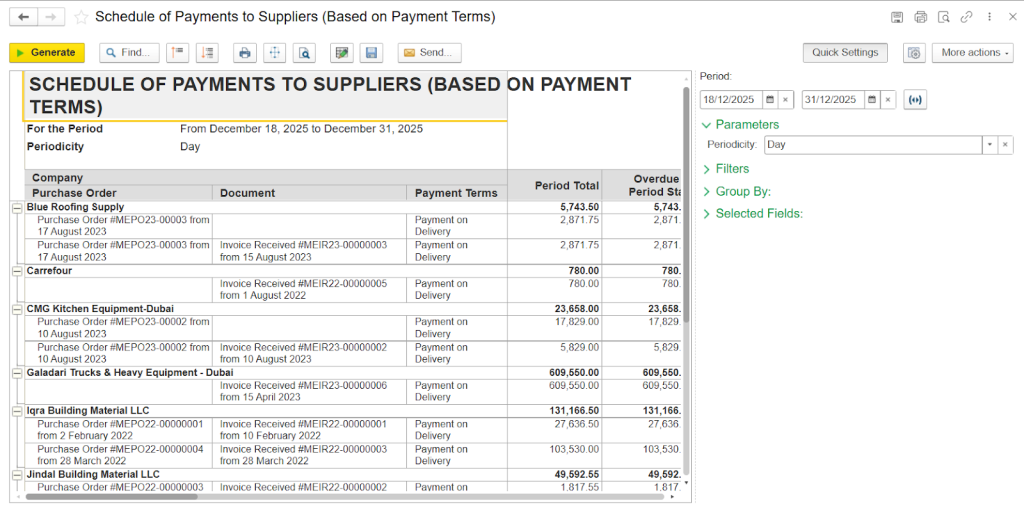

Payment schedules module in FirstBit ERP

Procurement is tied to budgets and cost control.First Bit positions procurement as integrated with cost control and financial reporting, so purchases align with project budgets and financial visibility.

Inventory-threshold purchasing automation.First Bit’s procurement module is described as supporting automated PO generation when inventory drops below a set threshold.

Together, these capabilities turn digital procurement into a controlled workflow instead of a set of disconnected tasks. For Vision 2030 projects, that structure helps procurement teams move faster while keeping supplier selection, approvals, and purchasing decisions traceable. It also supports the current trends in construction procurement where transparency and execution discipline increasingly influence project performance.

Conclusion

Vision 2030 is shaping procurement in construction by raising expectations for control, traceability, and delivery discipline. Procurement decisions now carry more weight because they directly affect schedule and cost outcomes.

For contractors, the priority is consistency. When workflows, approvals, and supplier decisions stay structured, teams reduce commercial leakage and avoid delay-driven buying.

This is where digital procurement supports the current trends in construction procurement in a practical way. It helps contractors keep execution predictable under pressure while aligning with the wider construction procurement trends in the market.

FAQ

How is Vision 2030 changing construction procurement in Saudi Arabia?

It is raising expectations for procurement governance, localization, sustainability alignment, and traceability. In practice, this shifts trends in construction procurement toward clearer supplier qualification, documented decisions, and tighter control of project spend.

Why is digital procurement now essential for KSA contractors?

Project scale and oversight expectations require faster approvals, cleaner records, and reliable visibility into commitments and deliveries. Digital procurement supports this by standardizing workflows and making procurement decisions easier to track.

How does BOQ-based purchasing improve procurement accuracy?

It links each purchase to a defined scope line, quantity, and cost code. This reduces off-scope buying, improves forecast accuracy, and makes variation-related purchasing easier to control.

What role does real-time data play in modern construction procurement?

It shows what is approved, ordered, delivered, and still pending across projects. That visibility helps teams act earlier on delays, pricing shifts, and supplier issues, which is central to current trends in construction procurement.

Umme Aimon Shabbir

Editor at First Bit

Aimon brings a deep understanding of the modern construction business to her articles. Her strength is providing practical content that enhances users’ understanding and usage of the software in the industry. As an editor, Aimon helps our authors reach their full potential and produce their best work.